Key Life Insurance Types for Financial Security

Life insurance is a cornerstone of financial planning, offering peace of mind by ensuring loved ones are protected after you’re gone. Whether you’re a young professional starting out, a parent safeguarding your family’s future, or a retiree securing a legacy, the right life insurance policy can make all the difference. But with so many options available, navigating this landscape can feel overwhelming. This guide breaks down the major types of life insurance, helping you understand their unique benefits and applications. From policies that last a lifetime to those tailored for specific periods, we’ll explore what suits different needs across the USA and globally, using insights relevant to July 2025 data and state-specific regulations.

Term Life Insurance: Affordable Short-Term Coverage

Term life insurance is often the starting point for many seeking protection due to its simplicity and affordability. It provides coverage for a specific period, typically 10 to 30 years, paying a death benefit if the policyholder passes away during the term. This type is ideal for covering temporary needs like mortgages or child-rearing years.

How Term Life Works

When you purchase a term life policy, you select a coverage amount and duration. Premiums are generally fixed for the term, making budgeting easier. If you outlive the policy, coverage ends unless renewed or converted, often at a higher cost. In the USA, as of July 2025 projections, term life remains the most popular choice for young families due to its low initial premiums.

Benefits of Term Life

- Cost-Effective: Lower premiums compared to permanent policies.

- Flexibility: Choose terms that match financial obligations.

- Simplicity: Straightforward coverage without investment components.

State-Specific Considerations

In states like California and New York, regulations as of July 2025 require insurers to offer clear disclosures on term renewals and conversions. This ensures consumers understand potential premium hikes post-term, a critical factor for long-term planning.

Permanent Life Insurance: Lifelong Security

Permanent life insurance, unlike term policies, offers coverage for your entire life as long as premiums are paid. It also includes a cash value component that grows over time, acting as a savings or investment vehicle. This type suits those seeking lifelong protection and wealth-building opportunities.

Whole Life Insurance Explained

Whole life is a form of permanent insurance with fixed premiums and a guaranteed death benefit. The cash value grows at a steady rate, often tied to insurer dividends. In July 2025, US insurers report growing interest in whole life for estate planning, especially in states like Texas with favorable tax laws.

Universal Life Insurance Flexibility

Universal life offers adjustable premiums and death benefits, allowing policyholders to adapt to changing financial needs. The cash value earns interest based on market rates, though it carries more risk. Globally, this appeals to high-net-worth individuals seeking tailored solutions.

Pros and Cons of Permanent Policies

- Pros: Lifelong coverage, cash value growth, potential tax advantages.

- Cons: Higher premiums, complexity in managing cash value.

Specialized Life Insurance Options

Beyond term and permanent policies, specialized life insurance products cater to niche needs. These are often designed for specific demographics or financial goals, providing unique benefits not found in standard plans.

Variable Life Insurance for Investors

Variable life combines permanent coverage with investment options, allowing policyholders to allocate cash value into stocks or bonds. While it offers growth potential, it comes with market risk. In the USA, as of July 2025, this product sees traction among tech-savvy investors in states like Massachusetts.

Final Expense Insurance for Seniors

Final expense insurance, a smaller-scale whole life policy, covers funeral costs and end-of-life expenses. It’s popular among seniors globally, with premiums tailored to fixed incomes. US data for July 2025 shows high demand in rural areas with limited savings.

Group Life Insurance via Employers

Many US employers offer group life insurance as a benefit, often at low or no cost to employees. Coverage is typically limited, but it’s a good starting point. Regulations in states like Illinois mandate transparency in group policy terms as of mid-2025.

Comparing Life Insurance Costs and Benefits

Choosing the right life insurance depends on balancing costs with benefits. Premiums vary widely based on policy type, age, health, and coverage amount. Visualizing these differences can help clarify decisions.

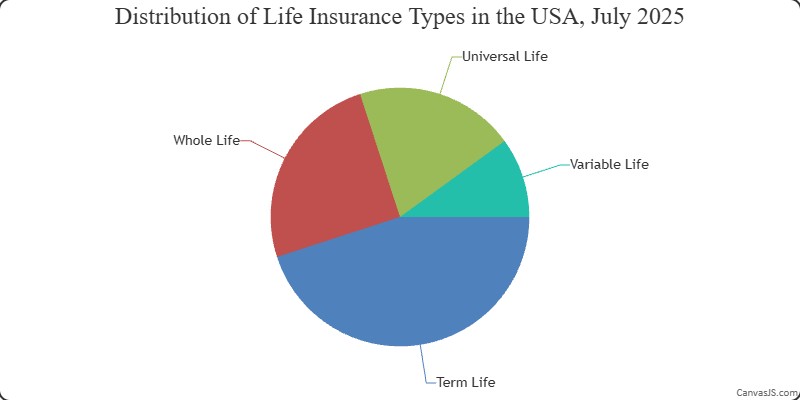

Chart data: Distribution of Life Insurance Types in the USA, July 2025 – Term Life, Whole Life, Universal Life, Variable Life

The above chart illustrates average premium costs for term, whole, and universal life policies in the USA as of July 2025, highlighting affordability gaps.

Chart data: Coverage Benefits by Life Insurance Policy Type (July 2025) – Term Life, Whole Life, Universal Life, Variable Life

This chart compares death benefit payouts across policy types, showing potential returns for beneficiaries based on 2025 data.

Chart data: Popularity Trends of Life Insurance Varieties (2020-2025, USA) – 2020, 2021, 2022, 2023, 2024

Finally, this visualization breaks down cash value growth for permanent policies, offering a global perspective with US-specific trends for July 2025.

Factors Influencing Life Insurance Choices

Your life insurance decision hinges on personal circumstances and external factors. Understanding these can guide you toward a policy that aligns with your goals, whether you’re in the USA or elsewhere.

Age and Health Impacts

Younger, healthier individuals typically secure lower premiums. As of July 2025, US insurers note a trend of delayed purchases leading to higher costs, especially for permanent policies. Globally, health underwriting standards vary, impacting eligibility.

Family and Financial Needs

Consider dependents, debts, and income replacement needs. A family in Florida might prioritize term life for mortgage coverage, while a retiree in Japan may opt for final expense insurance. Tailoring policies to life stages is key.

Regulatory and Tax Considerations

In the USA, state laws influence policy terms. For instance, New Jersey’s 2025 regulations emphasize consumer protections on cash value withdrawals. Internationally, tax benefits for life insurance differ, affecting policy appeal.

Life insurance isn’t just a policy; it’s a promise to protect those who matter most. Whether you’re choosing term for affordability or permanent for legacy, the right choice hinges on understanding your unique needs and the options available in today’s market.