Key Health Insurance Insights for Global Readers

In recent years, health insurance has become a cornerstone of financial security for individuals and families across the USA and beyond. With rising medical costs and evolving regulations, staying informed about the latest trends is more critical than ever. As of July 2025, the health insurance landscape reflects a dynamic mix of policy changes, technological advancements, and economic pressures. This article dives deep into the current state of health insurance in the USA, offering actionable insights for both American residents and global readers seeking to understand this complex system. Whether you’re an individual navigating coverage options or a business owner securing plans for employees, understanding these shifts can save you time, money, and stress. Let’s explore the key trends shaping health insurance today and how they impact policyholders worldwide.

Policy Changes Driving Health Insurance Costs

Federal Updates Impacting Premiums

As of July 2025, federal policies in the USA continue to influence health insurance premiums. Recent adjustments to the Affordable Care Act (ACA) subsidies have expanded eligibility for lower-income households, yet many middle-income families face rising costs due to inflation. States like California and New York have introduced additional mandates for coverage, pushing insurers to adjust pricing models. For global readers, this underscores how government intervention can reshape private insurance markets overnight.

State-Specific Regulations to Watch

State-level regulations add another layer of complexity. For instance, Texas has relaxed certain ACA requirements, leading to more affordable but less comprehensive plans. Meanwhile, Massachusetts maintains strict coverage mandates, ensuring broader protection at a higher cost. These variations highlight the importance of localized knowledge when selecting a plan, a lesson applicable to countries with decentralized healthcare systems.

Employer-Sponsored Plan Adjustments

Employer-sponsored health plans, a staple for millions of Americans, are also shifting. In July 2025, data shows a 7% increase in employer contributions to premiums, though many are offsetting costs by offering high-deductible plans. This trend mirrors global shifts toward cost-sharing models, where employees bear more financial responsibility for care.

Technology Transforming Health Insurance Access

Telehealth Integration in Plans

Telehealth has become a game-changer in health insurance as of July 2025. Most major insurers in the USA now include virtual consultations as a standard benefit, reducing costs for routine care. This trend resonates globally, especially in regions with limited access to in-person medical facilities, showcasing how technology can bridge healthcare gaps.

AI-Driven Claims Processing

Artificial intelligence is streamlining claims processing, with insurers like UnitedHealthcare adopting AI tools to reduce approval times by 30%. This efficiency benefits policyholders with faster payouts, a model that international insurers are beginning to emulate. However, concerns about data privacy remain a hot topic for debate.

Digital Enrollment Platforms

Digital enrollment platforms have surged in popularity, allowing consumers to compare plans and enroll online. In July 2025, over 60% of new ACA marketplace enrollments occurred through mobile apps or websites, a trend that simplifies access for tech-savvy users worldwide.

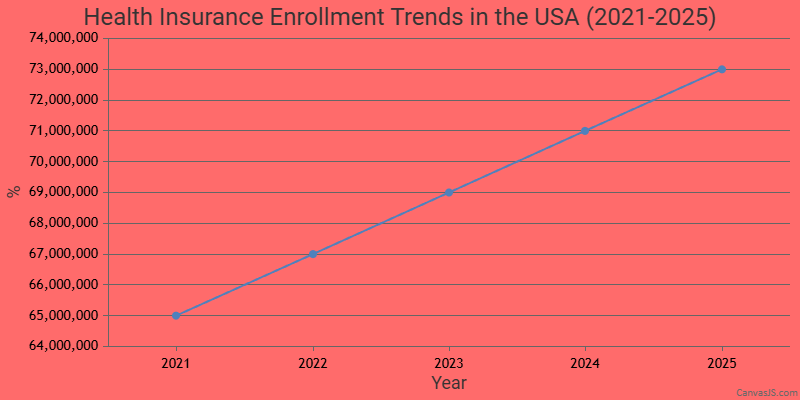

Chart data: Health Insurance Premium Trends in the USA (2021-2025) – 2021, 2022, 2023, 2024, 2025

Rising Costs and Consumer Strategies

Inflation’s Impact on Premiums

Inflation continues to drive health insurance premiums upward in the USA. July 2025 data indicates a national average increase of 5.8% for individual plans compared to the previous year. This mirrors global economic pressures, where healthcare costs often outpace wage growth, leaving consumers searching for solutions.

Tips for Affordable Coverage

Finding affordable health insurance requires strategic planning. Here are some key tips for consumers:

- Compare plans on federal and state marketplaces for subsidies.

- Consider high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs).

- Review network restrictions to avoid out-of-pocket costs for out-of-network care.

- Explore catastrophic plans if you’re young and healthy, minimizing premium expenses.

Global Lessons in Cost Management

Globally, countries like Germany and Singapore offer lessons in balancing cost and care through hybrid public-private systems. While the USA’s system remains unique, adopting elements like transparent pricing could help curb rising expenses for American consumers.

Chart data: Health Insurance Enrollment by Policy Type in the USA (July 2025) – Employer-Sponsored, Marketplace (ACA), Medicaid, Medicare

Emerging Coverage Gaps and Solutions

Underinsured Populations in Focus

Despite progress, millions of Americans remain underinsured as of July 2025. Rural areas, particularly in states like Mississippi and Oklahoma, report higher rates of inadequate coverage due to limited provider networks. This issue parallels challenges in developing nations, where access to care often dictates insurance value.

Specialty Care Coverage Challenges

Specialty care, such as mental health and chronic disease management, often falls outside standard plans. Advocacy groups in the USA are pushing for broader mandates, a movement gaining traction globally as awareness of holistic healthcare grows.

Innovative Solutions on the Horizon

Insurers are piloting innovative solutions, such as bundled care packages for chronic conditions. These programs, seen in states like Florida, aim to reduce long-term costs by focusing on prevention—a strategy with universal appeal for healthcare systems under strain.

“The health insurance landscape in July 2025 shows both challenges and opportunities. With rising costs and technological advancements, consumers must stay proactive to secure affordable, comprehensive coverage that meets their unique needs in the USA and beyond.”

Chart data: Geographic Variations in Health Insurance Adoption Across the USA (July 2025) – California, Texas, Florida, New York, Illinois

Looking Ahead: What’s Next for Health Insurance?

Predicted Regulatory Shifts

Looking forward from July 2025, experts anticipate further regulatory debates in the USA over single-payer systems versus private insurance dominance. State experiments, like California’s public option proposals, could set precedents for national policy, influencing global discussions on universal coverage.

Consumer Empowerment Trends

Consumer empowerment is on the rise, with tools like price transparency apps gaining traction. These resources help policyholders make informed decisions, a trend that could inspire similar innovations in markets worldwide.

Global Collaboration Opportunities

Finally, global collaboration offers hope for tackling shared challenges. The USA’s health insurance struggles—cost, access, equity—mirror issues in many nations. By sharing data and strategies, insurers and policymakers can craft solutions that benefit all, from New York to Nairobi.