Secure Your Future with Life Insurance Plans

Life insurance isn’t just a policy; it’s a promise to protect those who matter most. Whether you’re a young professional starting out, a parent building a family, or nearing retirement, the right life insurance plan can offer peace of mind and financial security. With the landscape of insurance evolving, understanding your options in July 2025 is more critical than ever. From state-specific regulations in the USA to global trends shaping coverage, this guide dives deep into crafting a strategy that fits your unique needs. Let’s explore how life insurance can be a cornerstone of your financial planning, no matter where you are in the world.

Why Life Insurance Matters Now More Than Ever

Economic Uncertainty and Family Protection

In July 2025, economic fluctuations continue to challenge households across the USA and globally. Rising inflation and unpredictable job markets underscore the need for a safety net. Life insurance ensures that if the unexpected happens, your loved ones aren’t left struggling with debts or daily expenses. For instance, in states like California and New York, where living costs are high, a robust policy can cover mortgages or education costs.

- Protects against income loss during economic downturns.

- Covers critical expenses like housing and schooling.

- Offers stability in high-cost regions of the USA.

Shifting Demographics and Needs

As populations age in countries like the USA and Japan, life insurance adapts to new realities. Older adults may seek policies for estate planning, while younger generations prioritize affordability. Data from July 2025 shows a growing demand for flexible plans that cater to diverse life stages, making it vital to choose a policy that evolves with you.

Global Risks and Local Regulations

From pandemics to natural disasters, global risks highlight the importance of life insurance. In the USA, state regulations—such as Texas mandating clear disclosure of policy terms—ensure transparency but vary widely. Understanding these local rules alongside international trends helps you select a plan with worldwide relevance.

Types of Life Insurance to Consider

Term Life: Affordable and Temporary

Term life insurance remains a popular choice for its simplicity and cost-effectiveness. As of July 2025, premiums in the USA average lower than permanent plans, making it ideal for young families or those with short-term financial goals. It provides coverage for a set period, ensuring protection during critical years like raising children or paying off a mortgage.

- Lower premiums compared to whole life options.

- Fixed duration, often 10 to 30 years.

- Best for temporary needs like debt coverage.

Whole Life: Lifelong Security

Whole life insurance offers permanent coverage with a cash value component that grows over time. In July 2025, this type appeals to those in states like Florida, where estate taxes can burden heirs. While premiums are higher, the policy doubles as a savings tool, providing global appeal for long-term planners.

Universal Life: Flexible and Customizable

Universal life insurance blends flexibility with lifelong coverage. You can adjust premiums and death benefits as circumstances change—an attractive feature for international clients or expats in the USA. Data from July 2025 indicates growing interest in these adaptable plans amid shifting financial priorities.

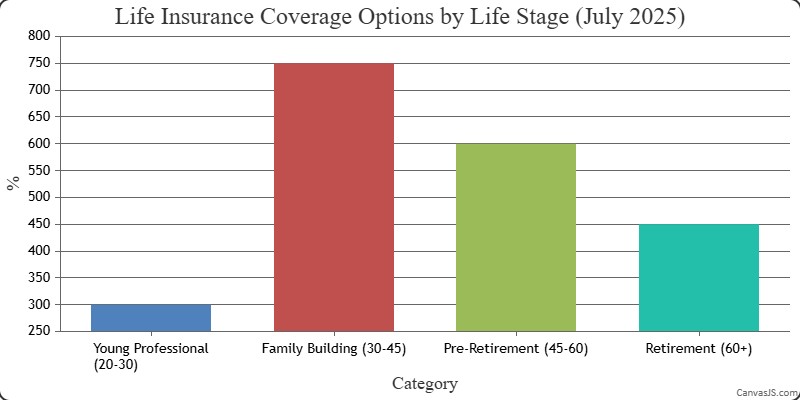

Chart data: Coverage Options by Life Stage in 2025 – Young Professional (20-30), New Parents (30-40), Mid-Career (40-50), Pre-Retirement (50-60)

Factors Influencing Life Insurance Decisions

Age and Health Considerations

Your age and health significantly impact premiums and eligibility. In July 2025, insurers in the USA often use advanced health screenings to assess risk, especially in states like Illinois with strict underwriting guidelines. Locking in a policy while young and healthy can save thousands over time, a strategy relevant worldwide.

- Younger applicants often secure lower rates.

- Health conditions may increase premiums.

- Early planning maximizes affordability.

Income and Financial Obligations

Your income level and debts shape the coverage you need. For example, a single parent in Georgia might prioritize a higher death benefit to cover childcare costs. Globally, aligning your policy with financial responsibilities ensures it serves its purpose without overextending your budget.

Lifestyle and Risk Factors

High-risk hobbies or occupations can raise premiums. Data from July 2025 shows insurers scrutinizing activities like skydiving or jobs in hazardous industries, particularly in states like Alaska. Whether you’re in the USA or abroad, disclosing lifestyle details upfront avoids policy disputes later.

Chart data: Trends in Life Insurance Adoption (2020-2025) – 2020, 2021, 2022, 2023, 2024

How to Choose the Right Policy for You

Assess Your Coverage Needs

Start by calculating how much coverage your dependents require. In July 2025, tools and calculators offered by USA-based insurers help estimate needs based on income, debts, and future goals. This step is universal—whether in New York or New Delhi, knowing your target amount guides smarter choices.

Compare Providers and Plans

Not all insurers are equal. Some offer better rates for term life in states like Ohio, while others excel in whole life products globally. Reviewing customer feedback and financial stability ratings as of July 2025 ensures you partner with a reliable provider, no matter your location.

- Look for insurers with strong financial ratings.

- Compare policy features beyond just price.

- Check state-specific offerings and restrictions.

Work with a Trusted Advisor

Navigating life insurance can be complex, especially with varying regulations across USA states like Michigan or international markets. A licensed advisor can tailor recommendations to your situation, ensuring compliance with local laws while addressing global concerns as of July 2025.

“Life insurance isn’t just about death; it’s about living with confidence. Choosing the right policy in 2025 means securing your family’s future against any uncertainty, whether you’re in the USA or halfway across the globe. It’s a decision that pays off in peace of mind.”

Emerging Trends Shaping Life Insurance

Technology and Personalized Policies

By July 2025, technology continues to revolutionize life insurance. Insurers in the USA use AI to offer personalized plans based on real-time health data from wearables. This trend, also gaining traction globally, means policies better match individual risks and lifestyles, enhancing value for policyholders.

Sustainability and Ethical Investing

More insurers are tying life insurance cash values to sustainable investments. In states like Oregon, companies promote eco-friendly funds as of July 2025, appealing to socially conscious buyers. This global movement reflects a shift toward aligning financial products with personal values.

Increased Focus on Mental Health

Mental health considerations are becoming central to underwriting. In July 2025, some USA insurers in states like Massachusetts offer riders for mental health support, a trend spreading internationally. Recognizing holistic well-being ensures policies address modern challenges faced by families everywhere.

Chart data: Life Insurance Strategy Preferences by Demographic Group (July 2025) – Young Professionals (25-35), Parents (35-50), Pre-Retirees (50-65)