Secure Your Loved Ones with Life Insurance

Life insurance is more than a financial product; it’s a promise to protect those who matter most. Whether you’re a young parent in Texas or a retiree planning your legacy in London, the right policy can provide peace of mind and financial stability. With evolving needs and diverse offerings, choosing a life insurance plan can feel overwhelming. This guide dives into the core aspects of life insurance policies, offering insights tailored to families in the USA while addressing global considerations. From understanding policy types to navigating state-specific regulations, we’ll help you make informed decisions. Let’s explore how life insurance can safeguard your family’s future, no matter where you are.

Understanding Life Insurance Policy Types

Term Life Insurance: Affordable Protection

Term life insurance offers coverage for a specific period, often 10, 20, or 30 years. It’s a popular choice for families seeking affordable premiums with straightforward benefits. If the policyholder passes away during the term, beneficiaries receive a death benefit. In the USA, as of July 2025, term life policies remain the most cost-effective option for young families in states like California, where cost of living pressures demand budget-friendly solutions.

- Ideal for temporary needs, like covering a mortgage.

- Premiums are often lower compared to permanent policies.

- No cash value accumulation, focusing solely on death benefits.

Whole Life Insurance: Lifelong Coverage

Whole life insurance provides coverage for the policyholder’s entire life, as long as premiums are paid. It also builds cash value over time, which can be borrowed against or withdrawn. This type appeals to those in high-cost states like New York, where families often seek dual benefits of protection and savings. Globally, it’s favored by individuals planning long-term wealth transfer.

- Guaranteed death benefit and cash value growth.

- Higher premiums due to lifelong coverage.

- Useful for estate planning across borders.

Universal Life Insurance: Flexible Options

Universal life insurance blends the permanence of whole life with flexibility in premiums and death benefits. Policyholders can adjust payments based on financial changes, a feature valuable in fluctuating economies like those in Florida, where hurricane risks impact budgets as of July 2025. It’s also adaptable for international clients with varying income streams.

- Adjustable premiums and benefits over time.

- Cash value growth tied to market performance.

- Requires active management for optimal results.

Factors to Consider When Choosing a Policy

Coverage Needs Based on Life Stage

Your life stage heavily influences the type of policy you need. Young parents might prioritize term life to cover children’s education, while those nearing retirement in states like Arizona may focus on whole life for legacy planning. As of July 2025, economic uncertainties in the USA highlight the need for tailored coverage that matches personal milestones.

- Assess dependents’ financial needs.

- Consider future expenses like college or retirement.

- Evaluate income replacement requirements.

Premium Costs and Budget Constraints

Premiums vary widely based on policy type, age, health, and location. In Texas, for instance, state regulations as of July 2025 allow competitive pricing for term life, making it accessible for middle-income families. Globally, exchange rate fluctuations can affect premium affordability for expatriates, underscoring the need for careful budgeting.

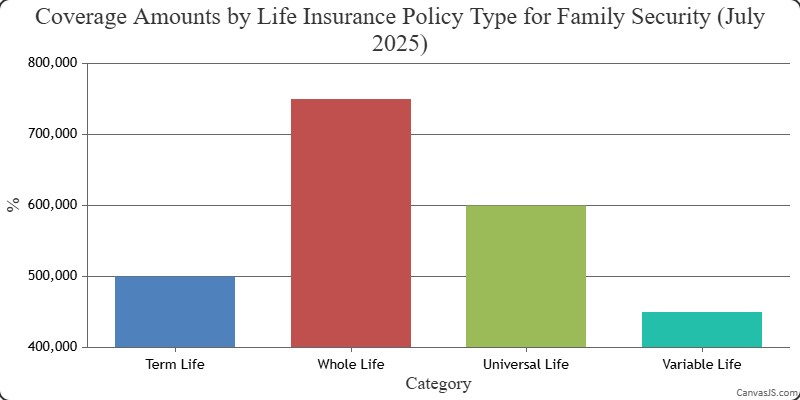

Chart data: Coverage Amounts by Life Insurance Policy Type for Family Security (July 2025) – Term Life, Whole Life, Universal Life, Variable Life

- Compare quotes from multiple insurers.

- Factor in annual income and debt obligations.

- Look for discounts or bundled policies.

Insurer Reliability and Reputation

Choosing a reputable insurer is critical. In the USA, companies are rated by agencies like AM Best for financial strength, a key consideration in states like Illinois with stringent insurance laws as of July 2025. For a global audience, check if the insurer operates internationally and honors claims across borders.

- Research insurer ratings and customer reviews.

- Ensure compliance with local regulations.

- Verify claim settlement history.

State-Specific Regulations in the USA

Impact of State Laws on Policy Terms

Life insurance regulations vary across US states. As of July 2025, California mandates clear disclosure of policy fees, benefiting consumers with transparency. In contrast, states like Georgia have fewer restrictions, which can lead to varied premium structures. Understanding these differences is crucial for US residents.

Chart data: 2025 Distribution of Life Insurance Policy Preferences for Family Security – Term Life, Whole Life, Universal Life, Variable Life

- Check state insurance department guidelines.

- Be aware of mandatory waiting periods or exclusions.

- Consult local agents for compliance details.

Tax Implications by State

Death benefits are generally tax-free at the federal level, but some states impose estate taxes that affect payouts. For instance, in July 2025, Massachusetts applies estate taxes on larger policies, impacting beneficiaries. This is less of a concern in states like Florida with no estate tax, offering a planning advantage.

- Research state-specific estate tax thresholds.

- Consult tax advisors for large policies.

- Consider trusts to minimize tax burdens.

Global Considerations for Life Insurance

Cross-Border Policy Challenges

For those with ties to multiple countries, life insurance can be complex. Policies purchased in the USA may not be recognized in nations with strict insurance laws, as noted in July 2025 data. Expatriates must ensure their coverage aligns with residency and tax requirements in their host country.

- Verify policy validity in your country of residence.

- Understand currency conversion impacts on payouts.

- Seek insurers with international presence.

Cultural and Economic Influences

Cultural attitudes toward life insurance differ globally. In the USA, it’s often seen as essential for family security, while in some Asian countries, it’s tied to long-term savings as of July 2025. Economic stability also plays a role—hyperinflation in certain regions can erode policy value, requiring careful planning.

Chart data: Trends in Life Insurance Adoption for Family Security (2015-2025) – 2015, 2017, 2019, 2021, 2023-25 (Projected)

- Consider local economic trends when choosing coverage.

- Account for cultural perceptions of insurance.

- Opt for policies with inflation protection if available.

Life insurance isn’t just a contract; it’s a lifeline for your family. Choosing the right policy means balancing cost, coverage, and future needs. In an uncertain world, as seen in July 2025 trends, a well-thought-out plan can be the difference between struggle and stability for your loved ones.

Tips for Securing the Right Policy

Work with a Licensed Advisor

A licensed advisor can navigate the complexities of life insurance, especially with state-specific rules in the USA as of July 2025. They can also provide insights for international clients, ensuring policies meet diverse needs.

- Choose advisors familiar with your state’s laws.

- Discuss long-term goals and family dynamics.

- Ask for personalized policy comparisons.

Regularly Review and Update Coverage

Life changes—marriage, children, or relocation—necessitate policy updates. In July 2025, economic shifts in the USA underscore the importance of revisiting coverage to align with inflation and new financial goals. This applies globally as well, with changing tax laws affecting benefits.

- Review policies every 2–3 years or after major life events.

- Adjust coverage for inflation or new dependents.

- Update beneficiaries to reflect current wishes.

Leverage Technology for Comparisons

Online tools and platforms make comparing life insurance policies easier than ever. As of July 2025, US-based websites offer detailed breakdowns of premiums and benefits, while global aggregators cater to international needs, helping you find competitive rates.

- Use trusted comparison sites for quotes.

- Check user ratings for digital platforms.

- Ensure data privacy when sharing personal details.