Tailored Life Insurance Solutions for Everyone

Life insurance is a cornerstone of financial planning, offering peace of mind and protection for loved ones across the globe. Whether you’re in the USA, where regulations vary by state, or elsewhere, choosing the right policy can feel overwhelming. With diverse options and complex terms, the journey to secure coverage demands clarity and insight. This guide, crafted with data insights as of July 2025, aims to simplify the process. From understanding policy types to factoring in regional nuances, we’ll explore how to align life insurance with your unique circumstances. Let’s dive into actionable strategies and expert tips to ensure your family’s future is safeguarded, no matter where you are.

Understanding Life Insurance Fundamentals

What Is Life Insurance and Why It Matters

Life insurance is a contract between you and an insurer, where a payout—known as a death benefit—is provided to your beneficiaries upon your passing. This financial safety net can cover funeral costs, debts, or daily expenses. In the USA, as of July 2025, the demand for such protection remains high, with millions prioritizing coverage amid economic uncertainties. Globally, the concept holds similar weight, though cultural attitudes toward insurance differ. The core purpose, however, is universal: to shield loved ones from financial hardship.

Key Policy Components to Know

Every life insurance policy includes critical elements like premiums (your regular payments), coverage amount (the benefit paid out), and term length (how long the policy lasts). Riders, or add-ons, such as accelerated death benefits, can customize your plan. Understanding these components helps you avoid overpaying or underinsuring. For instance, in states like California, regulations as of July 2025 mandate clear disclosure of fees, ensuring transparency for policyholders.

Common Misconceptions Debunked

Many believe life insurance is only for the elderly or wealthy, but that’s far from true. Young families, single parents, and even debt-free individuals benefit from coverage. Another myth is that policies are unaffordable—yet, with tailored options, many find plans fitting tight budgets. Clearing these misunderstandings is the first step to making informed choices, whether you’re in New York or Nairobi.

Types of Life Insurance Policies Explained

Term Life: Affordable and Temporary

Term life insurance offers coverage for a specific period, often 10 to 30 years, at a lower cost. It’s ideal for those with temporary needs, like paying off a mortgage. In the USA, as per July 2025 data, term life remains the most popular choice due to its simplicity. Globally, it appeals to budget-conscious individuals seeking straightforward protection.

- Fixed premiums for the term duration.

- No cash value or savings component.

- Renewable, though rates may rise post-term.

Whole Life: Lifelong Coverage with Benefits

Whole life insurance provides permanent protection with a cash value component that grows over time. Premiums are higher, but the policy can act as a financial asset. In states like Texas, tax advantages on cash value growth, noted in July 2025 regulations, make this attractive. Internationally, it’s favored by those planning for legacy or wealth transfer.

Universal Life: Flexible and Adjustable

Universal life offers lifelong coverage with adjustable premiums and death benefits, adapting to changing needs. As of July 2025, this flexibility resonates with Americans facing economic shifts. For a global audience, its adaptability suits varying income levels, though it requires active management to maintain value.

Factors Influencing Life Insurance Decisions

Age and Health Considerations

Your age and health significantly impact premiums and eligibility. Younger, healthier individuals secure lower rates, while pre-existing conditions may raise costs or limit options. In the USA, insurers often use health screenings, with state-specific rules as of July 2025 ensuring fair practices. Globally, access to medical data varies, affecting underwriting processes.

Financial Goals and Family Needs

Consider your dependents’ needs—education, housing, or debt repayment—when choosing coverage. A single parent in Florida might prioritize a high death benefit, while a retiree in Japan may focus on funeral costs. Tailoring your policy to these goals, as reflected in July 2025 trends, ensures relevance across borders.

Regional Regulations and Costs

In the USA, life insurance is regulated at the state level, with places like Illinois enforcing strict consumer protections as of July 2025. Costs also vary—urban areas often see higher premiums due to risk factors. Internationally, government policies shape affordability, making local research vital before committing.

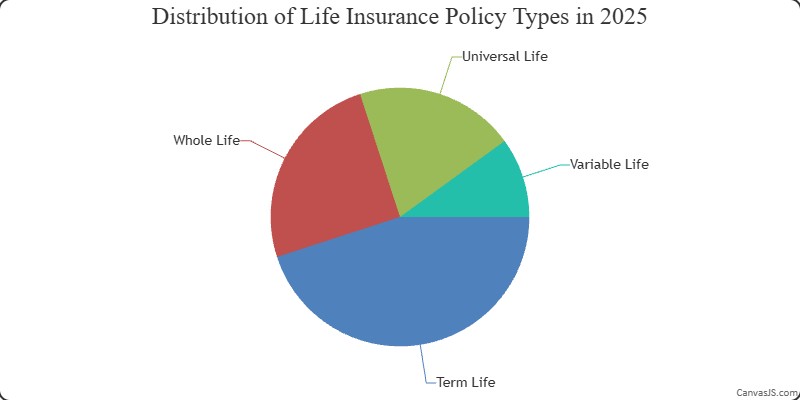

Chart data: Distribution of Life Insurance Policy Types in 2025 – Term Life, Whole Life, Universal Life, Variable Life

How to Choose the Right Policy for You

Assess Your Coverage Needs

Start by calculating expenses your family would face without you—debts, income replacement, or future goals. Tools and calculators, widely used in the USA as of July 2025, simplify this. Globally, cultural priorities, like supporting extended family, may shift the focus, but the principle of need-based planning remains constant.

- List all financial obligations and timelines.

- Factor in inflation and rising costs.

- Consult with advisors for personalized insights.

Compare Providers and Quotes

Shopping around is crucial. In the USA, platforms aggregate quotes, reflecting competitive rates as of July 2025. Look at insurer ratings for financial stability and customer service. For international readers, local brokers often provide tailored comparisons, bridging gaps in market knowledge.

Chart data: Comparison of Life Insurance Coverage Options by Region (2025) – Northeast USA, South USA, Midwest USA, West USA, Global Average

Understand Policy Exclusions and Terms

Read the fine print. Exclusions—like certain causes of death or waiting periods—can void claims if misunderstood. In states like Ohio, July 2025 laws require clear language in contracts, a model for consumer rights worldwide. Knowing these details prevents surprises during claims.

“Life insurance isn’t just a policy; it’s a promise to protect those who matter most. Choosing wisely means balancing cost, coverage, and peace of mind—don’t rush the decision, as it shapes your family’s future.”

Emerging Trends in Life Insurance Worldwide

Technology’s Role in Policy Access

Digital platforms are transforming how we buy life insurance. In the USA, by July 2025, online applications with instant approvals are commonplace, streamlining access. Globally, mobile apps cater to underserved regions, democratizing coverage despite infrastructural challenges.

Focus on Personalized Plans

Insurers now leverage data analytics to offer customized policies. As of July 2025, American companies use AI to predict needs, while global markets adopt similar tech at varying paces. This shift ensures policies match individual lifestyles, from urban professionals to rural families.

Sustainability and Ethical Underwriting

There’s growing emphasis on ethical practices. In the USA, some insurers by July 2025 tie premiums to eco-friendly behaviors, a trend gaining traction in Europe too. This aligns with a global push for social responsibility, reshaping how policies are marketed and perceived.

Chart data: Trends in Life Insurance Policy Selection (2021-2025) – 2021, 2022, 2023, 2024, 2025